Your rates explained

Published on 31 July 2023

At the beginning of the year, all property owners would have received a letter from the Valuer General notifying them that their land value has increased (or decreased). This new land value will be evident when you receive your rates notice.

It is important to remember that your land value is determined by the Valuer Generals office every three years, not by your local council. The value of your land does not necessarily mean an increase to your rates notice and how much you pay for services to Council.

Your rates notice and charges will look a little different depending on where you live and what services you have access to across the Yass Valley.

Below is a breakdown of some of the charges you may see on your notice and what these charges mean.

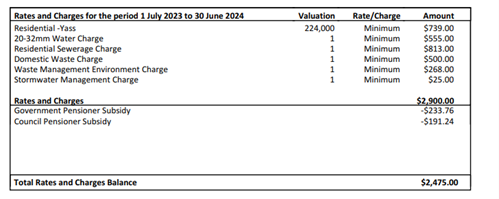

General rates: The first line under rates and charges on your notice is your figure for General Rates. This figure is based on the unimproved land values supplied to Council and the landowner by the NSW Valuer General. Unimproved land values are determined by the NSW Valuer General every three years. As Council’s rates income is limited by rate pegging, an increase (or decrease) in your land value does not necessarily mean a corresponding increase (or decrease) in your general rates. All rateable land within the local government area is categorised as either residential, business or farmland depending on the lands dominant use. Subcategories of these three categories may be used based on centres of population (ie: Towns or Villages) within the LGA.

Water Availability Charge: All rateable properties that are within 225 metres of a Council water main, are charged for water availability whether connected to the water supply or not.

Sewerage Availability Charge: All rateable properties that are within 75 metres of a Council sewer, are charged for sewer availability whether connected to the service or not. For residential properties, this is a fixed yearly charge. For non-residential properties, the charge is determined by previous water usage with a minimum charge applicable.

Domestic Waste Management Charge: All residential properties within a designated garbage collection area are provided with a weekly garbage collection and a fortnightly recycling service. Under the Local Government Act, it is mandatory for all rateable properties within the designated collection area (including vacant land) to be charged for this service.

Waste Management Environmental Charge: All rateable properties within the local government area are required to pay a waste management environmental charge. The income from this charge is used to offset the cost of Council’s waste management and recycling operations. This charge is also used for Capital Works and Operational improvements to all seven transfer stations across the Yass Valley and for rehabilitation of old landfill sites within the LGA. Funds are also intended for use for investigation and participation in programs that aim to reduce waste to landfill via circular economy initiatives.

This charge also takes into consideration the financial impact of the Boxing Day fire that destroyed 80% of the Hume Recycling Facility. Recycling materials that are delivered to Hume for processing are now transported to other facilities across NSW and VIC. This additional transportation has increased our fees for recycling management.

Please note: This charge is not to be confused with kerbside service and the running and maintenance of garbage vehicles which is taken from the Domestic Waste Management charge.

Stormwater Management Charge: Property owners within the Yass township are required to pay a stormwater management charge that contributes to the cost of providing new or additional stormwater services. Non rateable or vacant properties are exempt from this charge.

Onsite Sewage Management Charge: All property owners with an onsite sewage management system (septic tank, AWTS or worm farm etc) are required to pay this annual charge. This ensures the landowner is compliant with Section 68 of the Local Government Act 1993 which requires a current 'Approval to Operate' for all systems.

A note for Pension Rebated notices:

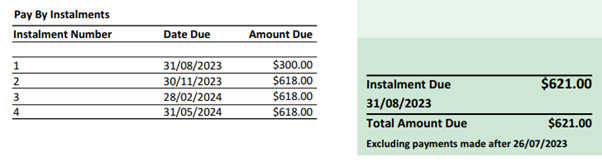

Due to a system processing error, pension rebated notices will show an incorrect figure for Instalment Number 1 in the table (see below). Please disregard this figure. When making payment, please refer to the ‘instalment due’ amount shown in the green shaded box on the right-hand side of the notice. We are very sorry for the confusion this has caused.

Payment arrangements and financial hardship relief:

We understand that it is a difficult time for the community with a rise in the cost of living. If you have difficulty paying your rates on time, please call Council to discuss possible alternative arrangements. If you are suffering severe financial difficulties, you can fill out our financial hardship relief application at www.yassvalley.nsw.gov.au/Our-Services/Customer-Service/Forms-and-applications

For more information on your land value and how this value is determined, please visit: https://www.valuergeneral.nsw.gov.au/